If you want to become a broker you need to consider which forex risk model you will implement in your business. There are two main types of forex brokers and it is up to you how you’ll set up your business and execute trades. Some brokers use A-Book and B-Book models together when others choose just one. Which forex risk model is the right one for you?

Pros and cons of A-Book brokers

First of all, many traders value the A-Book model for the lack of conflict between the broker and the investor. A-Book broker makes money by increasing the spread or charging commissions on the volume of transactions. Therefore, he doesn’t distress investors’ conditions to make profits. From a broker’s perspective, it is a safe model, because he gains revenue regardless of whether the trader is making or losing. The profits of the broker are stable and depend solely on the turnover.

In the A-book model, you have to be prepared for depositing with counterparties, including liquidity providers. In one word, It is up to the third party to execute the trade. If you need detailed advice on what to do when choosing a liquidity provider download our Guide for Brokers: Liquidity.

B-Book model in Forex

The B-book model is a forex risk model that can bring quick and high profits, as well as drive a broker into depression.

B-Book brokers process their clients’ orders in house and act as market makers. There is no external liquidity pool, as the broker executes trades internally. A broker’s profit in this model is equal to a trader’s loss because he always acts as a counterparty to his clients. So is the B-Book model profitable at all for forex brokers?

In this industry, it is not only the profit that counts, but also how many traders stay & return to the broker. When clients quit the profits are gone. Take a look at our infographic and learn how to attract more traders into your trading platform.

The hybrid of A-Book and B-Book risk models

Many forex brokers apply them both, as it allows them to make more profit while building long term relations with their customers. How do brokers use both a-book and b-book?

The trick is to properly qualify the traders or trades to the right category. Brokers use dedicated software to successfully divide traders and implement the hybrid model in their orders. This tool allows them to track the amount of a trader’s deposit, the leverage used, the risk taken with each transaction, the use or non-use of protective stops, etc. On this basis, it is decided whether a trader’s transaction will be executed in the A-Book or B-Book model.

Risk management tool for A-Book and B-Book brokers

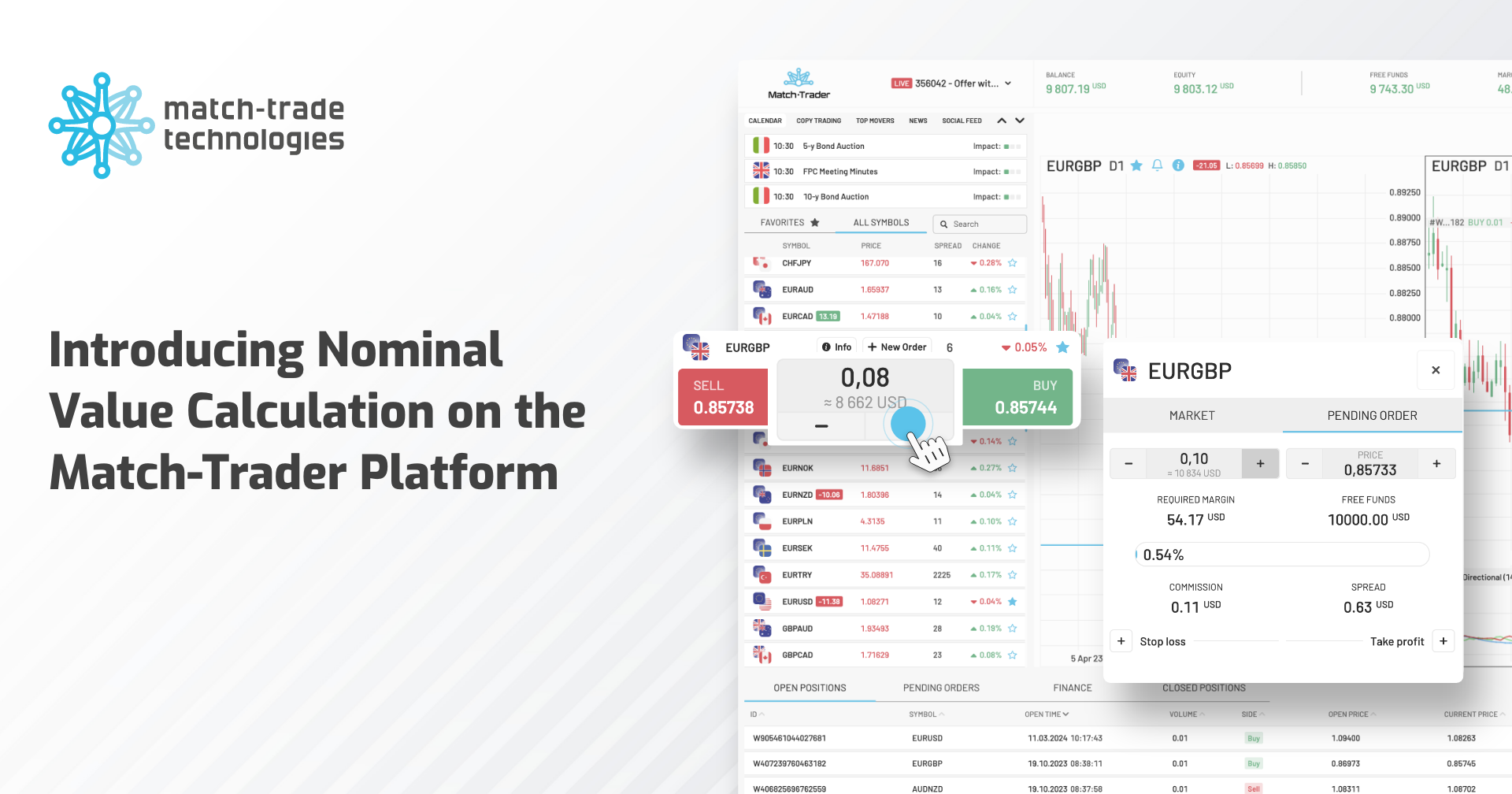

Match-Trader’s risk management system facilitates trade differentiation. Our analytical platform allows the broker to manage clients’ critical risk exposures. Flexible reporting tools enable real-time, scheduled and ad hoc reports. The intuitive interface easily reveals all the features that enable efficient use of the forex risk hybrid model.

This means that not every trader’s order falls into the same category. What’s more, thanks to the additional profits that the broker gets on the traders placed in the b-book model, he can provide all his clients with very competitive spreads, regardless of whether they are profitable or not.